The Future of Funding

Our award-winning finance platform connects borrowers, lenders and intermediaries, bringing big ideas to life

200+ Lenders

Specialist Advice

No Broker Fees

Best Rates

Find your Funding

Cutting-edge technology backed by a team of financial experts. Our platform is a one-stop solution for anyone seeking instant and guaranteed lending options.

Why Choose Us?

Speed

Instantly match with specialist lenders that are pre-qualified and ready to fund your plans.Access

Our platform gives you access to over 200 bespoke lending options, tailored to your requirements

Value

Our smart-search software means you’re guaranteed the best rates in the market. Plus, we don’t charge a broker fee.

Support

Monitor your enquiry in real-time, while receiving specialist support from our expert team of advisers.

Connect with over 200 trusted lenders

Property Finance

We specialise in Property Finance including:

- Commercial Mortgages

- Property Development Finance

- Portfolio Finance

- Bridging Loans

- and more…

Instantly match with lenders for your specific loan requirements.

Business Finance

We specialise in Business Finance including:

- Business Credit Cards

- Invoice Finance

- Asset Finance

- Trade Finance

- and more…

Instantly match with the perfect business finance lenders in the UK.

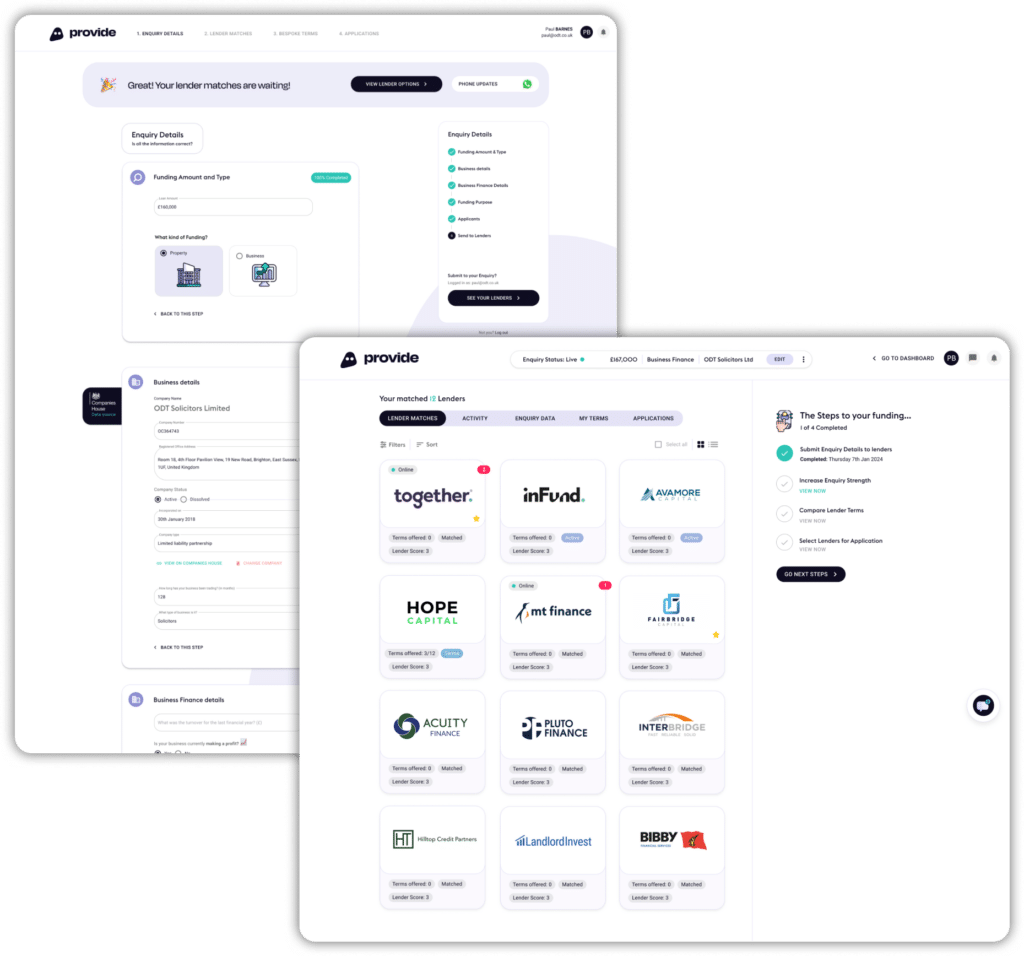

How It Works

Submit Enquiry

Click ‘Match with Lenders’ below and submit your enquiry.

Matching Engine

Our software matches you with our specialist lenders.

Connect With Lenders

Engage directly with the lenders and view your deals progress in real-time.

Chat To Support

We offer step-by-step support to help you get the best deal possible. Use our live chat, or call 0800 772 3180.

Provide Finance for Brokers

Provide Finance’s broker dashboard helps brokers deliver exceptional support to their clients. The platform incorporates software for brokers to quickly communicate and exchange secure documents with all parties, making the process as simple as possible.

What Our Clients Say

Read Our Latest Articles

Access The Best Deals

* Average Loan Completion refers to our average bridging loan approval period.